| |

| |

| |

| Presented By PhRMA |

| |

| Axios Vitals |

| By Tina Reed · Nov 02, 2022 |

| We're halfway through the week, Vitals readers. Today's newsletter is 1,198 words or a 4½-minute read. 😎 Coming soon ... Axios Pro: Health Care Policy will debut in mid-November. Reserve your free trial today. |

| |

| |

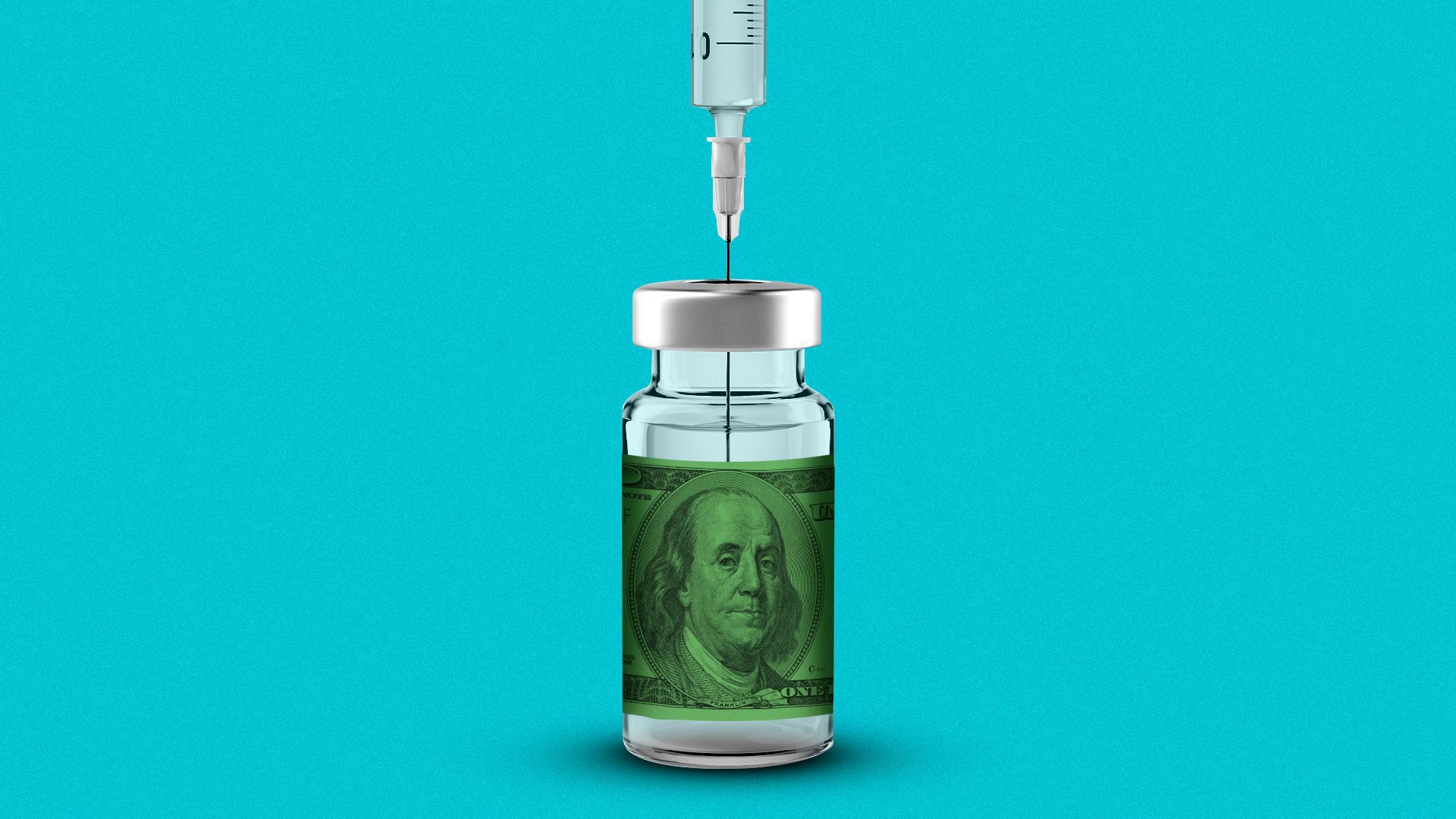

| 1 big thing: The next health care wars are about costs |

|

|

| Illustration: Natalie Peeples/Axios |

| |

| All signs point to a crushing surge in health care costs for patients and employers next year — and that means industry groups are about to brawl over who pays the price, Axios' Caitlin Owens writes. Why it matters: The surge could build pressure on Congress to stop ignoring the underlying costs that make care increasingly unaffordable for everyday Americans — and make billions for health care companies. - This year's Democratic legislation allowing Medicare to negotiate drug prices was a rare case of addressing costs amid intense drug industry lobbying against it. Even so, it was a watered-down version.

- But the drug industry isn't alone in its willingness to fight for the status quo, and that fight frequently pits one industry group against another.

Where it stands: Even insured Americans are struggling to afford care, the inevitable result of years of cost-shifting by employers and insurers onto patients through higher premiums, deductibles and other out-of-pocket costs. - But employers are now struggling to attract and retain workers, and forcing employees to shoulder more costs seems like a less viable option.

- The all-but-inevitable recession heading for the U.S. will make patients more cost-sensitive, putting families in a bind if they get sick.

- Rising medical debt, increased price transparency and questionable debt collection practices have rubbed some of the good-guy sheen off of hospitals and providers.

- All of this is coming to a boiling point. The question isn't whether, but when.

The bottom line: Someone is going to have to pay for the coming cost surge, whether that's patients, taxpayers, employers or the health care companies profiting off of the system. Each industry group is fighting like hell to make sure it isn't them. Sign up for Axios Pro Health Care Policy for a special pre-launch edition about which cost battles to watch. |

|

| |

| |

| 2. Gaming out the winners and losers |

|

|

| Chart: Courtesy of McKinsey |

| |

| Employers, patients or taxpayers could be on the hook for hundreds of billions of dollars in additional spending if providers and insurers successfully shift inflation-driven costs, according to a recent McKinsey analysis, Caitlin writes. Why it matters: The health care sector's profits are severely at risk, per the analysis. But key players could yet dodge this bullet. By the numbers: The analysis predicts a $370 billion increase in U.S. health expenses by 2027, thanks to rising labor and supply costs. - McKinsey also surveyed health care leaders who reported expected drops in margins between 25 and 75%.

Between the lines: These rising costs will initially be borne by providers. It'll take years to shift costs to insurers or the government through contract negotiations or changes to federal reimbursement. - Insurers will attempt to pass their increased costs to employers, who will then have to decide whether to pass along costs to workers.

Yes, but: "While they may seem like the easiest path, payers recognize that price increases beyond historical levels are unsustainable; therefore, other actions will be needed," the authors write. "The actual financers of healthcare — employers, government, and consumers — can't afford more than historical levels of increase, if that." |

|

| |

| |

| 3. FDA panel probes pulse oximeter accuracy issues |

|

|

| Illustration: Megan Robinson/Axios |

| |

| Outside advisers to the FDA on Tuesday found "a clear signal" that pulse oximeters are less accurate for people with darker skin after scrutinizing evidence during a daylong meeting, Axios' Sabrina Moreno writes. Why it matters: The expert panel's consensus that inaccuracies pose a distinct clinical risk for dark-skinned patients sets the stage for the FDA to further scrutinize manufacturing standards for the devices, which measure oxygen levels in the blood. Driving the news: Wednesday's meeting followed years of longstanding concerns that were brought to the fore during the COVID-19 pandemic, when oximeters were widely used at home and in clinical settings. - A 2020 article in the New England Journal of Medicine stated Black patients were nearly three times more likely than white patients to have low oxygen levels that go undetected.

- A September analysis from Sutter Health found Black COVID patients may have faced up to five hours in treatment delays due to inaccurate readings.

Yes, but: The panel split over recommendations for how to limit these inaccuracies in the future. - "There needs to be transparency around it. How much inaccuracy is permissible? I'm not sure that there's a right answer," said panel chair Steven Nathan, the medical director of Inova's Advanced Lung Disease and Lung Transplant Program.

|

|

| |

| |

| A message from PhRMA |

| Americans want policy reforms that improve their insurance |

| |

|

| |

| Did you know 39% of insured Americans say they don't understand what's covered by their insurance? Health insurance coverage should be predictable and transparent, and insured Americans agree. Learn more from PhRMA's latest Patient Experience Survey report. |

| |

| |

| 4. CMS finalizes discount drug payment policy |

|

|

| Illustration: Aïda Amer/Axios |

| |

| Medicare will increase payments for discounted drugs provided to safety-net hospitals next year under a policy the Biden administration finalized Tuesday that will affect how the program reimburses other facilities. The big picture: Hospitals had called on the CMS to boost safety-net drug payments without dipping into other funds, but the agency said it didn't have the authority to do that. - Still, CMS agreed it could use a methodology that offered a slightly more favorable outcome.

- Urban hospitals will see a positive effect from the policy, while rural hospitals will see a slight pay cut, CMS predicted.

- Overall, pay rates for hospital outpatient facilities and ambulatory surgical centers will increase 3.8% in 2023.

Flashback: This summer, the Supreme Court invalidated CMS' payment cuts for safety-net providers in the federal discount drug program. Research had indicated some hospitals were profiting excessively from the program. - The agency didn't have time to make a formal proposal about how to pay hospitals for the discounted drugs going forward, so it is beginning to do that through the rule released Tuesday.

The intrigue: HHS still needs to figure out how to reimburse hospitals as much as $10 billion for the payment cuts between 2018 and 2022. The savings from the payment cuts have been redistributed, so either CMS needs to claw money back from other hospitals or ask Congress for help. Related: An overhaul for Medicare's pay transformation program |

|

| |

| |

| 5. Quote du jour: Pfizer prepares for price hike |

| "Look, I think what was very bold and absolutely the right decision was to price the [vaccine] during the pandemic at a very, very, very low price ... That was the right thing to do, and we did it and we maintained that for the years to come." — Albert Bourla, Pfizer's CEO During Pfizer's third-quarter earnings call on Tuesday, CEO Albert Bourla addressed a question about potential blowback to the company's plan to hike the price of its COVID-19 vaccine Comirnaty to between $110 and $130 a dose in 2023 when government purchases end and the company shifts sales to the commercial market. - That will be up from about $30 per dose the federal government paid, per the last supply contract the U.S. signed with Pfizer and its partner BioNTech, Fierce Pharma reported.

- He said the change represents its cost-effectiveness as well as its increased costs of selling the vaccine in single-dose vials.

- "People wouldn't see the difference because there's no co-pay," Bourla said during the earnings call.

Between the lines: The company raised its forecast for the year for its COVID vaccine sales by $2 billion to $34 billion, buoyed by U.S. sales of its Omicron-specific booster. It reaffirmed its forecast for $22 billion in sales of the antiviral Paxlovid. - Officials told analysts they anticipate Pfizer's COVID vaccines and therapies will "be quite relevant for many years to come." But Bourla said the company also has plans over the next 18 months to have up to 19 new products or indications in the market.

|

|

| |

| |

| A message from PhRMA |

| How insured Americans navigate unclear insurance coverage |

| |

|

| |

| According to new findings, insured Americans favor policy solutions that improve their ability to navigate and access their care while lowering their out-of-pocket costs. An example: Tackling the barriers introduced by insurers and middlemen like pharmacy benefit managers. Read more. |

| |

| Thanks for reading, and thanks to senior editor Adriel Bettelheim and senior copy editor Bryan McBournie for the edits. Did someone forward this email to you? Here's how to sign up. |

| | Why stop here? Let's go Pro. | | |

No comments