Big tech

Amazon discounts One Medical memberships

File this under one the most obvious things that could happen: Amazon Prime members will now be eligible for discounted membership at One Medical. When Amazon acquired the care provider last year for close to $4 billion, the health care world went wild with theories about the retail giant's grand plans and what it all meant. Turns out that an early move is an effort to boost sales at One Medical by enticing loyal Amazon customers. It's not that much different than offering cheaper produce to Prime members at Whole Foods.

This announcement has already lead to more commentary. Arielle Trzcinski from Forrester was in my inbox almost immediately, saying that the "move enables Amazon to bring its healthcare options together to create a more seamless customer experience, which consumers are craving" and pointing out that "this announcement comes as flu and cold season is gearing up and many consumers are going through open enrollment, including seniors evaluating Medicare Advantage plan options."

Virtual care

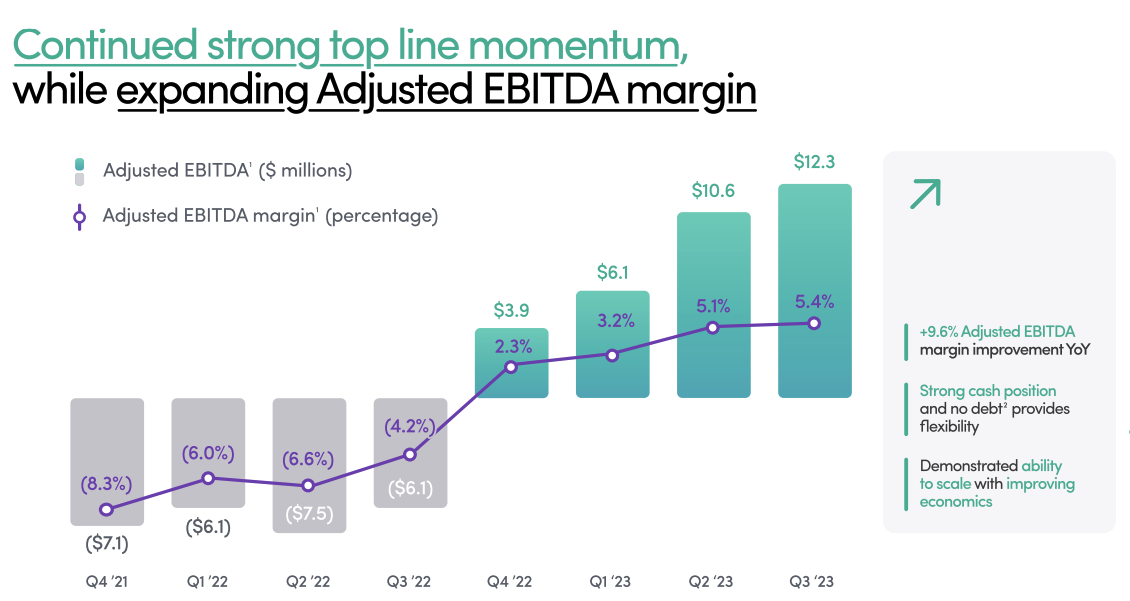

Hims & Hers projects net profit

Hims & Hers Health, which provides virtual care with a focus on providing people with access to a range of drugs and products for common health needs, reported strong third quarter results, suggesting that among the glut of companies providing very similar services, Hims will emerge as one of the winners. On the company's earnings call, leaders expressed that they expect the company to post "positive net income" in the first half of 2024 — if not potentially by the end of this year. Hims has been reporting an adjusted profit but a net loss for the last couple of quarters.

The company also announced MedMatch, a machine learning technology trained on the company's data that's designed to help its providers "identify the most optimal treatment for a particular person, from medication formulary to dosage, to form factor," CEO Andrew Dudum said on the company's earnings call. The hope is that the technology will inspire trust with consumers and help them get to the right treatment faster without trial and error. The service will be launched first on customers seeking mental health treatment.

Lizzys device digest

FDA news from J&J and Recor

STAT's medical devices reporter Lizzy Lawrence sent a few dispatches of note:

- The FDA approved a surgical system targeting high blood pressure, called renal denervation, from startup Recor Medical, the company announced Wednesday. The system, which is a FDA-designated breakthrough device, was subject to an FDA advisory panel in August along with Medtronic. The panel voted in favor of Recor's device, but against Medtronic's — it had more contentious data. Read more here.

- Johnson & Johnson wants to start testing its general surgery robot in humans, and is asking the FDA for permission. The company announced its plans on Tuesday. The robot, called Otava, consists of four arms built into a surgical table. Successful clinical trials could make J&J a fierce competitor of Intuitive Surgical, which currently controls the surgical robot market with its Da Vinci products.

research

Is remote patient monitoring worth it?

Remote patient monitoring has the potential to improve chronic disease management — but with little clear evidence to drive best practices, experts have warned that using connected devices like blood pressure monitors on the wrong patients could drive up unnecessary spending. A new study in Annals of Internal Medicine starts to chip away at the problem of who the right RPM patients are. A national analysis of more than 100,000 hypertension patients on Medicare showed that most of the benefits of RPM, like more active medication management, came in the first four months of use. And the patients who benefited most were those who started with poor blood pressure control. Next up: Getting practices to align their use of the technology with those kinds of insights — and maybe reimbursement codes that don't incentivize indefinite use for everyone.

Read more from STAT's Katie Palmer here.

No comments