chart of the day

What's going on here?

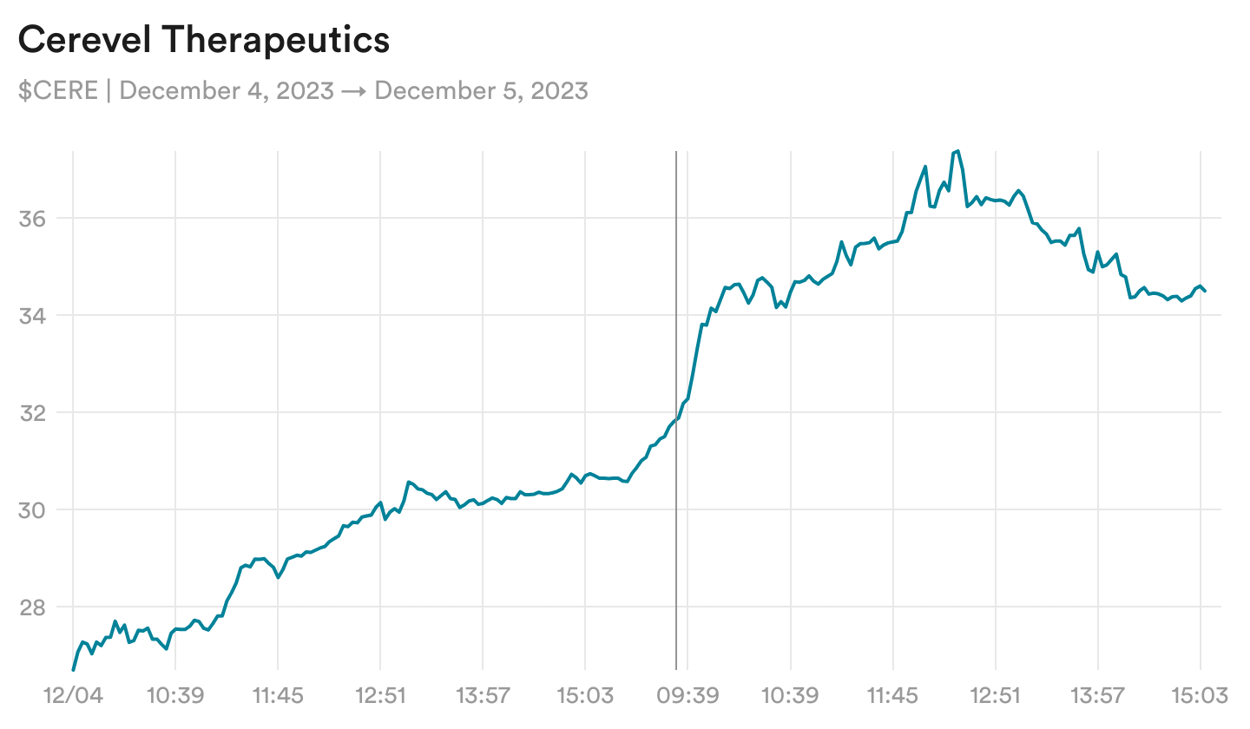

Cerevel Therapeutics, a neuroscience company that has had more clinical delays than clinical data in the past year, is up about 50% since Monday despite no news and no discernible changes to its chances of success.

The only thing on the calendar is a conference call, slated for next week, in which the company will explain in detail its investigational treatment for Parkinson's disease, which is now in Phase 3 development. Results aren't expected until 2024, which is to say there won't be any new data disclosed next week.

Generally, the likeliest explanation for a news-free biotech run-up is that a bunch of investors believe a given company is soon to be acquired. For Cerevel, the case for a buyout relies on two facts: Cervel has an investigational treatment for schizophrenia that is similar to one from Karuna Therapeutics, which is awaiting FDA approval, and, in May, the company hired Ron Renaud to be its CEO, recruiting a long-time biotech executive with a track record of selling small drugmakers to larger ones. Whether all that adds up to an impending deal remains to be seen, but investors seem convinced.

GLP-1 treatments

Evaluating Ozempic-style weight loss drugs

Read any article, research note, or Twitter screed about GLP-1 drugs and you'll probably run into the figure $100 billion, a commonly echoed estimate of just how much medicines like Wegovy will generate each year starting in around 2030. But how did everyone come up with that number?

"I think you can get there using Microsoft Excel pretty easily, right?" Jared Holz, a health care strategist at Mizuho, said at a STAT event this week. A nuance-averse analyst can simply plug in a drug price, multiply it by the more than 100 million Americans who are eligible for treatment, and come up with a world-historic revenue projection, Holz said. "But I think there's a few things in the way."

Among them is the fact that relatively few eligible patients are actually getting GLP-1 medicines, Holz said, and insurers are working hard to keep it that way. Then there's the reality of human behavior, said Liisa Bayko, managing director at Evercore ISI. Patients are likely to cycle on and off GLP-1 treatments, just as people do with diet and exercise, which could significantly cut into long-term sales potential.

Read more.

Washington

BIO finds a familiar face to be its CEO

BIO, a year removed from the messy departure of its CEO, has chosen biotech executive and rare disease advocate John Crowley to lead the organization.

As STAT's Rachel Cohrs reports, Crowley has been a member of BIO's board for more than a decade and serves as its vice chair. Crowley, 56, co-founded Novazyme Pharmaceuticals, a rare disease-focused biotech later sold to Genzyme, and then Amicus Therapeutics, where he serves as executive chairman.

His appointment marks a fresh start for BIO, which has suffered from the bruising departure of its prior CEO, Michelle McMurry-Heath, the organization's first Black woman leader, in 2022. Crowley will take over the role from interim CEO Rachel King.

Read more.

No comments