adam's biotech scorecard

What Vertex's buyout means for Vera

Last week, Vertex Pharmaceuticals bought Alpine Biosciences for $4.9 billion — driving up interest in other companies developing B-cell modulators. Writing in his weekly Biotech Scorecard, STAT's Adam Feuerstein points out that Vera Therapeutics might now be a very lucrative acquisition target. Alpine and Vera are very similar, with each blocking two proteins — B cell activating factor and a proliferation-inducing ligand — that play a role in autoimmune kidney disease.

Although Vertex described Alpine's experimental drug for IgA nephropathy as "best in class," Vera's drug for the same indication is further along in clinical trials. It's fair to say, Adam writes, that Vera could be a very logical target for many other companies.

In his column, Adam also elaborates on recent news from Cullinan Therapeutics, the dwindling ALS pipeline, and the good old days at Dendreon.

Read more.

M&A

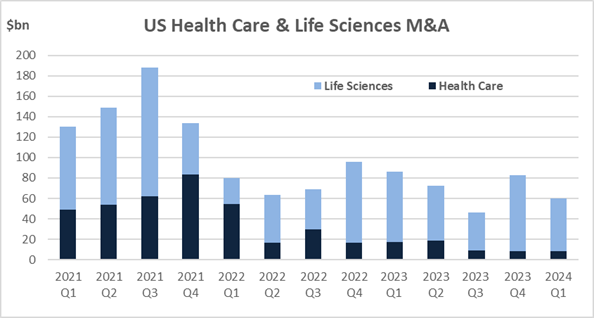

KPMG: Why life sciences M&A was weak last quarter

Life sciences dealmaking hasn't been great of late, a KPMG analysis shows. In the U.S., M&A activity totaled $59.7 billion in the first quarter of this year, down 31% compared to Q1 in 2023, when it was $86.2 billion. And in Q4 last year, these deals totaled $82.9 billion — representing a fairly significant plunge.

Inflation, interest rates, and the current regulatory environment are some of the main culprits. Companies are also taking a pause and integrating the businesses they've already acquired, so they've held off on further investment.

"On the positive side, we did see continued corporate divestments, targeted investments in health technology and artificial intelligence, and private equity interest stirring after a long lull," wrote Kristin Pothier, a life sciences sector leader for KPMG. She expects more deals to come this month and beyond.

No comments