pharma

Advisory panel date set for Lilly's donanemab — how much will it matter?

The FDA has set June 10 as the date for an advisory committee to meet about Eli Lilly's Alzheimer's candidate donanemab.

Back in March, the news that the agency will be convening advisers to discuss the drug came as a surprise. Donanemab, which aims to clear plaques of amyloid protein in the brain, succeeded in its Phase 3 trial, showing a 35% slowing of Alzheimer's disease progression versus placebo. Observers had expected the treatment to receive regulatory clearance earlier this year.

There were safety concerns, though. In the trial, 37% of participants treated with the drug experienced side effects related to ARIA, which causes brain swelling and bleeding, and three patients died. The FDA also has questions about the dosing regimen used in the trial. Lilly tested a unique "non-chronic" strategy of administering donanemab in monthly infusions, but only until patients' amyloid levels got below a certain threshold.

How much will this meeting affect Lilly? In another world where Mounjaro and Zepbound didn't exist, it would be a huge deal. But investors seem to now be more focused on obesity than Alzheimer's. Just for perspective — Biogen and Eisai's new Alzheimer's drug Leqembi, which got full approval last July, brought in $19 million in sales in the first quarter, while Lilly's Zepbound, which was approved last November and has been in shortage, brought in $517 million. This isn't the most fair comparison, since the rollout of Alzheimer's drugs will be slower given the need for infusion centers, but it still points to the massive market opportunity for obesity drugs.

M&A

Pharma has over $500B in capital for deals

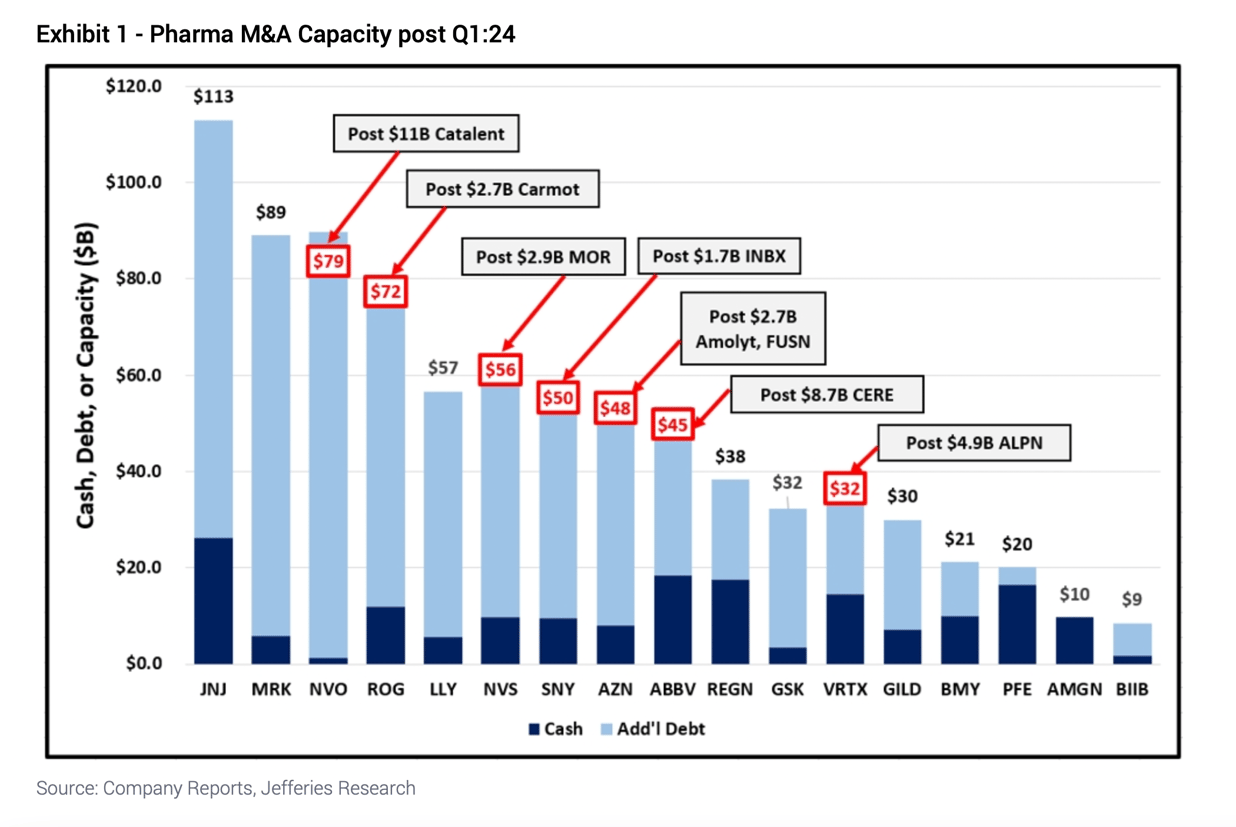

The industry has seen a decent amount of M&A so far this year, and there will likely be more deals for the rest of 2024, a team of Jefferies analysts led by Michael Yee wrote in a note yesterday.

So far this year, there have been 13 M&A deals with an average deal size of $2.6 billion in the pharma industry, representing mostly early-stage, bolt-on deals, the analysts said.

They estimate that companies in aggregate have over $500 billion in capacity for more deals, and these will likely occur in hot areas like cardiometabolic diseases and antibody-drug conjugates. Companies like Novo Nordisk, Eli Lilly, and Merck continue to be open to early-stage deals, they said, and there's pressure on the industry for M&A given the impact of Medicare's new drug negotiation program in the Inflation Reduction Act.

Gene therapy

Regeneron gene therapy helps two deaf children hear

An experimental gene therapy from Regeneron helped two congenitally deaf children hear, according to data from an ongoing Phase 1/2 trial presented at the ASGCT conference today.

This trial of the therapy, called DB-OTO, aims to enroll nearly two dozen children who have profound hearing loss due to changes in the otoferlin gene. The new results show that one child after 24 weeks had just mild hearing loss, and the other child after six weeks saw small improvements in hearing.

Several other companies are also studying therapies in this space, including Akouos, a subsidiary of Eli Lilly, and China-based Otovia Therapeutics.

Read more from STAT's Timmy Broderick.

No comments