lobbying

Patent-targeting bill was watered down by industry, sources say

Last week, legislators boasted about a bill passed by the Senate that aims to thwart the use of so-called "patent thickets," the slew of patents that companies hold to protect their brand-name drugs from generic competition.

But looking closely at the bill, some experts see it as only a modest achievement, and sources say the pharma industry has been lobbying to water it down for years.

Read more from my colleagues Ed Silverman and Rachel Cohrs Zhang.

politics

Menendez conviction leaves pharma with one less friend

After a New York jury yesterday found New Jersey Sen. Bob Menendez guilty on bribery and foreign-agent charges, he's unlikely to remain in his post. With that, the pharma industry will be losing a key ally on Capitol Hill.

Menendez's state is home to J&J and Merck, among other drugmakers, and his voting record has often aligned with the industry's interests. In 2019, he sided with Republicans voting against price caps and drug negotiations, and in 2021 he opposed pricing reform. He's also received significant donations from pharma CEOs.

Read more from my colleague Annalisa Merelli on who might replace Menendez and the implications for the industry.

financing

Cardiovascular startup Cardurion raises $260 million

Cardurion Pharmaceuticals has raised $260 million in a Series B round led by Ascenta Capital, a new VC firm led by former Moderna execs Lorence Kim and Evan Rachlin.

Startups don't often pursue drug candidates in heart disease, and even big pharma companies have backed out of this area at times. But this is where Cardurion's founders saw an opportunity. The startup is studying one drug in heart failure and another one in a rare genetic condition that causes people's hearts to beat too quickly.

Read more from my colleague Allison DeAngelis.

market check

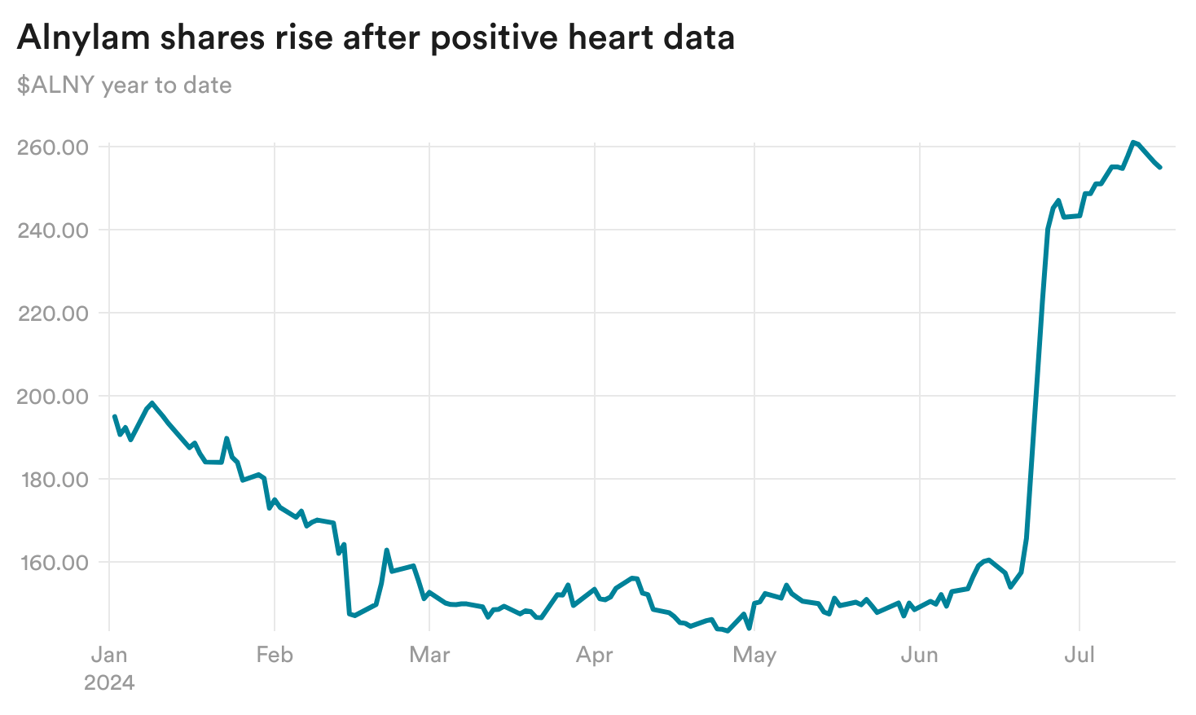

It's happy hour (for now) for Alnylam

Shares of Alnylam have been riding high since the biotech last month reported positive results from its pivotal HELIOS-B trial in ATTR-CM. The stock is now up 28% year-to-date.

There are still many lingering questions about the full dataset that will be presented at the European Society of Cardiology conference next month, but for now, Alnylam's founding CEO John Maraganore is basking in the stock surge while he can.

In his tweet, Maraganore said it's been a decades-long tradition of having nice champagne for every $50 increase in Alnylam's share price. It does indeed look to be a nice bottle.

No comments