data

De-identified health data deals are legal — but are they ethical?

Earlier this week Truveta announced a deal with Regeneron and Illumina to collect and sell patients' de-identified genomic data, and as STAT's Brittany Trang reports, there are a slew of companies doing similar things, many of them with medical imaging. These companies, including Avandra, Gradient Health, Segmed, and Protege advertise themselves as a way for hospitals to make "passive income" from their troves of patient data. These data brokers pitch themselves as "one-stop shops" for "locally sourced data" to companies looking to train AI models.

It's all legal. The health care privacy law HIPAA permits sharing de-identified patient data without patients' permission. But the rise of new business models raises questions about whether rules and practices should be updated to reflect today's technological realities.

Read the whole story about the tangled web here

business

AI investment in focus

In the past week we've seen a series of impressive AI fundraises announced, including mega deals for buzzy companies like Hippocratic AI. I spoke to VCs, including Bessemer Venture Partners' Sofia Guerra, Flare Capital's Parth Desai, and Define Ventures' Chirag Shah for a story this week about what's driving the dealmaking.

At a high-level, there's a lot of enthusiasm among health systems and payers — the adopters — for the potential of automated clinical documentation tools and other products to improve the experience of clinicians and patients, as well as for financial tools that can start delivering economic payoff quickly. The adopters have budgets allotted to try out tech and that helps drive investor confidence. Bottom line: Even as overall health tech funding is down, AI still has a lot of appeal. We'll have to see if the momentum keeps up for the rest of the year.

Read my story here.

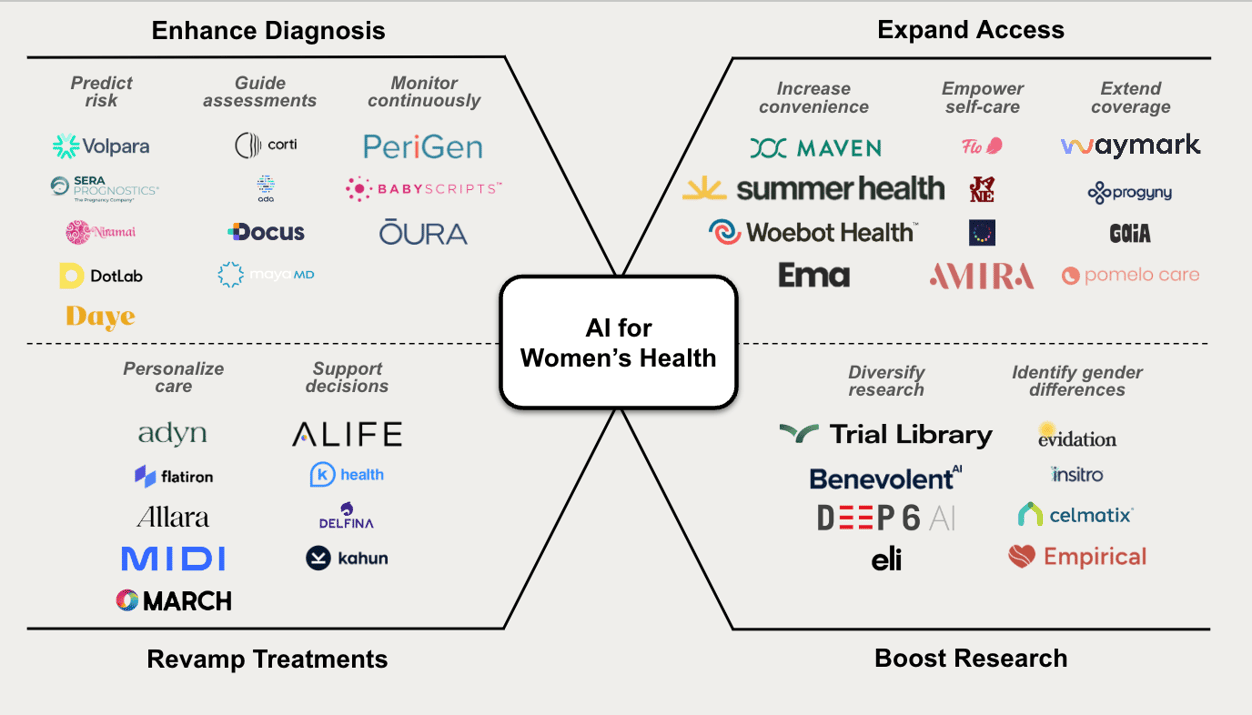

Separately, I appreciated some new work put out by Lux Capital's Deena Shakir and Shailee Samar looking specifically at AI funding for women's health startups. Women's health in general receives less funding than other areas, and the authors write that despite the tremendous growth in AI investment and adoption, "its application in women's health remains notably limited." The authors describe opportunities and also offer a list of startups working in the space and VCs known to fund women's health.

Business

JPM notebook: Wheel, Absci, Included

A few more items announced this week in the JPM flurry. If you missed it, check out our first roundup from earlier this week.

- Katie Palmer writes: Virtual health company Wheel announced a joint venture with international digital health company Huma, building a platform that partners, including pharma and health systems, can use to quickly stand up digital-first care. "We can launch in a matter of days what would have taken us months and years to launch," said Wheel CEO Michelle Davey.

- ICYMI: My write up on Chuck Divita's first prominent public appearance as the CEO of Teladoc Health. After seeing huge growth during the pandemic, the company's revenue has plateaued, and it has faced challenges stabilizing user numbers for its online therapy offering BetterHelp. Divita outlined his priorities, including international expansion, securing insurance coverage for BetterHelp, and growing users in its chronic disease programs.

- Brittany Trang writes: Absci's CEO Sean McClain spent the majority of his time explaining why the AI drug development company partnered with chipmaker AMD, which coincidentally last week made a $20 million investment in Absci. He played a 7-minute video of him chatting with AMD CTO Mark Papermaster, followed by 3 minutes of explaining why AMD's chips are good news for Absci — which came across more like a justification of why Absci didn't get Nvidia chips instead. McClain spent the rest of the session not talking about the company's most developed clinical candidate for inflammatory bowel disease, but on its drug candidate for hair regrowth. That candidate is expected to reach first-in-human studies next year and McClain says it will be Absci's flagship internal asset.

- Owen Tripp, the CEO of Included Health, a company that offers tech-forward health benefits for companies like Walmart, outlined many of the well established frustrations around employee sponsored health care. He reminded the audience about the company's high-profile deal to provide benefits for CalPERS, the retirement plan for California state workers. The risk-structured deal is the future for the sector, Tripp said. He also teased new offerings around pharmacy benefits, home-based care, and more.

No comments