Health IT

What Epic's president thinks of AI

While in Wisconsin for Epic's big annual customer meeting, STAT's Brittany Trang caught up with Sumit Rana, who is widely expected to take over the electronic health record company whenever CEO and co-founder Judy Faulkner steps down.

Rana started at Epic in 1998 and worked on the first version MyChart, the company's patient portal. He talked with Brittany about his philosophy on leadership, the potential for AI, and the company's approach to developing new products for customers.

Read more here

investment

Traits of successful health AI startups — and what's up with the bubble

Many believe a flood of AI investment is propping an otherwise shaky U.S. economy. Even OpenAI CEO Sam Altman thinks we're in an AI bubble. That's pretty alarming, if you believe that bubbles must pop.

Well, a new report from Flare Capital Partners — based on an analysis of 4,500 healthcare AI deals, a survey of health care executives, and other data — suggests there may be some fundamental business traction underlying the colossal valuations we're seeing for health AI. But there's also a limit to how many players can succeed and consolidation is coming.

Health AI, by the billions: Through the first half of 2025, 58% of deals have been for AI-related companies. At least 10 health AI companies have crossed $1 billion valuations in the last year, including Abridge, Ambience, OpenEvidence, Hippocratic AI, etc. And there have been five $1 billion-plus exits: SmarterDx, Iodine Software, Machinify Health, Office Ally, and Tempus AI. Exits tend to fuel investor confidence.

Admin rules the roost: Companies handling what are deemed administrative tasks, like calls, revenue cycle management, and claims operations, have done better for investors and see bigger valuations.

Adoption roaring: According to a Flare survey of health care execs, 50% currently allocate more than 10% of their IT budget to AI and 83% plan to increase their technology and AI budgets . Flare expects budgets for AI to continue growing for the next 12 to 24 months.

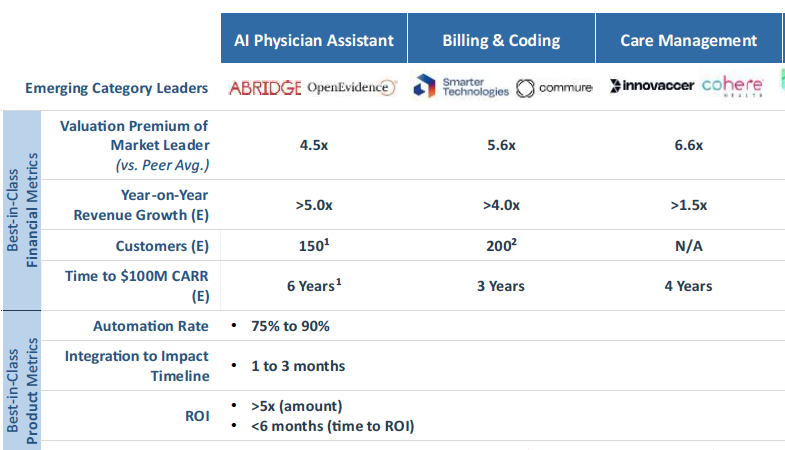

What leads to success? I cropped the below from a bigger, very useful chart analyzing characteristics of market leaders. Speedy installations and quick return on investment are helpful.

Are inflated valuations driven by FOMO? A bit, said Parth Desai, a partner at Flare, especially in the case of the multi-billion dollar valuations for companies that may be years from profitability. The counterargument is that thanks to impressive growth and the ability of companies to expand into new areas, say from scribing into billing, "some investors are giving these companies forward credit for growth they are relatively confident will come to fruition based on what customers are telling them about their locked in budgets and expansion plans."

What about that bubble? "What we are seeing in commercial data and buying behavior at the moment still suggests more durability both in ROI and enterprise spend than previous technology cycles," said Desai, "I think what's more likely than a bunch of bubbles bursting all at once is that there will be a lot more natural consolidation." Obvious winners will emerge and in some categories and the market isn't big enough for everyone. "Some type of reckoning is coming," said Desai.

What could go wrong? One risk that could play out in the next year is "AI-facilitated errors, mistakes, or fraud that cause financial or operational damage,: said Desai. "A good example of this is the risk that AI RCM companies may face from payer audits of AI-generated claims." This could lead to demands for more human review of AI output, slow down adoption, and hurt profitability.

No comments